Back to the Future: AI, Demographics, and DeLoreans

Great Scott!! For those of you who regularly follow our lame attempts at short-form video, you know that we generally focus on headline data of immediate interest – like stock market performance, inflation, Fed policy, and unemployment reports. And while these factors are important (thank you for watching), they are only the tip of the iceberg.

Looking to the future, we have to zoom out for a wider perspective ̶ and examine the factors that have historically served as the true engines of economic expansion and development:

- Demographic shifts, which present both challenges and opportunities that will shape economic landscapes for decades to come; and simultaneously

- Technological advancements, particularly in artificial intelligence (“AI”), which promise to transform industries and boost productivity in ways we are only beginning to comprehend.

What do you mean by “demographic shifts?”

Historically, economic expansion has relied crucially on growth in the local population to fuel it. As industry grows, and companies expand, so has the need for labor. More workers in one industry fuels expansion in other industries – those workers will surely need a place to live, a grocery store to shop at, a hospital when they’re sick, a Starbucks for coffee, and so on and so forth.

As economic prosperity grows, continued growth is dependent on the (historically) larger population of younger workers to both replace and support government programs like social security and Medicare. When the growth of a country's working-age population is more than that of it's dependents, it can supercharge an economy. However, across Europe, North America, and East Asia, birth rates are falling due to urbanization, increased female workforce participation, and the rising costs of child-rearing.

Many developed nations, such as Japan, Germany, and Italy, are experiencing significant increases in their elderly populations. For instance, in Japan, nearly 40% of their population is projected to be over the age of 65 by 2050.

Aging populations and shrinking workforce participation means fewer workers supporting more retirees, adding strain to public resources and hampering economic dynamism and innovation. A recent article in the WSJ illustrates this point perfectly, with an examination of China's one-child policy in hindsight.

So we’re doomed?

Not necessarily. While demographic changes will shape the workforce, technological advancements have the potential to boost productivity and efficiency, effectively allowing us to do more with less.

By 2050, it is estimated that two-thirds of the world's population will reside in urban areas in search of better economic opportunities and living standards. However, rapid urbanization can also lead to issues such as overcrowding, pollution, and inadequate infrastructure if not properly managed.

Enter AI.

AI can assist in urban planning by analyzing vast amounts of data to optimize traffic flow, manage waste, and reduce energy consumption. Smart city technologies, powered by AI, can improve public transportation, monitor air quality, and enhance public safety, making cities more livable and sustainable.

AI can also automate routine tasks, provide advanced data analysis, and improve decision-making processes. This can lead to higher productivity across various industries, helping economies adjust to demographic shifts. For instance, AI in healthcare can streamline diagnostics and treatment plans, reducing the burden on healthcare systems in aging societies. Automation can address labor shortages by performing tasks that would otherwise require human workers.

What about AI stocks?

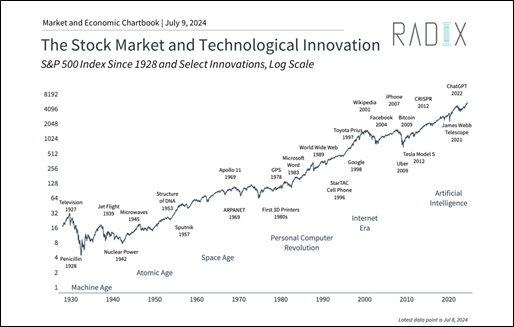

So far, examples of AI-boosted productivity in the business world have come mainly in the form of generating content, automating tasks, and analyzing data. It's hard to predict exactly what impact AI will eventually have, partly due to the pace of advancement, and partly because the impact of new technologies is simply hard to imagine. What's clear from the chart below is that the stock market did not move up in a straight line with past innovations, and many of their effects took years to materialize.

As computer scientist Roy Amara said:

“Investors tend to overestimate the impact of technology in the short-term and underestimate the effect in the long run.”

There are many examples of this throughout history, most recently with the dot-com boom and bust of the late 1990s and early 2000s. Many companies rushed to add .com and .net to their names, capitalizing on the demand for all things internet related. While these trends generated significant returns for many years, the bubbles eventually burst. The challenge is knowing if there is a bubble to begin with.

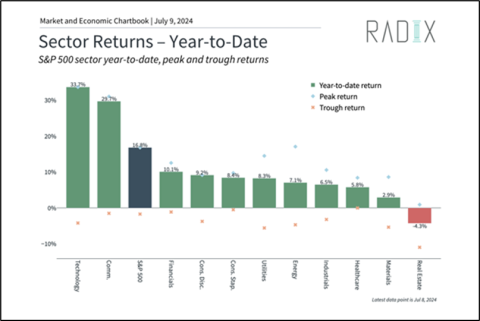

We’d argue that the most obvious difference between today's market and the dot-com bubble is that most of the large cap companies benefiting from these trends today are highly profitable (our favorite kind!). And while AI stocks do offer exciting opportunities (and we own several of them), they can also pose undue risks from market volatility and over concentration within a portfolio. This year to date, returns from only 10 stocks has accounted for approximately 67% of total market return. Nvidia ALONE was responsible for 25%.

Diversifying across various sectors helps us to mitigate these risks, often at the expense of underperforming the highly concentrated S&P 500. The below chart shows that while technology-related sectors such as Communication Services and Information Technology have outperformed, other sectors have done well this year too.

Maintaining a long-term investment perspective is essential. Technological innovations and demographic shifts can take years, if not decades, to fully realize their impact on the economy. Remaining diversified amid market exuberance will allow you to benefit from recent trends around AI innovations while still positioning your portfolio for long-term growth.

Conclusion

Future long-term economic growth will be significantly influenced by demographic shifts and technological advancements. Aging populations and declining birth rates in developed countries present challenges, while youthful populations in developing regions offer opportunities. Urbanization will continue to shape economic landscapes, and technological innovations, particularly AI, will play a crucial role in enhancing productivity and supporting economic growth.

In an election year like 2024, there is a lot of political rhetoric and fear surrounding AI and the threat of robots taking our jobs. However, what I hope we’ve illustrated, is that for developed nations to continue to prosper, we MUST embrace ways to increase productivity with a shrinking labor force. To do otherwise puts us at tremendous risk.

By understanding and leveraging these underlying drivers, you can position yourself for sustained growth and success in the evolving global economy. See you there!

Jess & Amy