Three Financial Distractions That Could Cost You in 2024

Happy New Year!

The S&P 500 ended the year up 24%. Excellent by any measure, despite the worst banking crisis since 2008, rapid Fed rate hikes, debt ceilings and budget battles in Washington, the ongoing war in Ukraine, the conflict in the Middle East, cracks in China's economy, and many more.

Despite everyone (except us) predicting that the US would fall into a deep self-imposed recession, the markets proceeded to march confidently back to all-time highs, just like they always do.

Throughout our nine-year history, we have never published a quarterly investment letter recommending defensive action. It’s not that we believe the markets won’t go down, we do, it’s rather that we believe that long-term opportunities can exist in all market environments, just like in 2023. And further, that long-term ROI is rarely fully exhibited within an arbitrary 365-day bracket of time.

There will always be a reason to sell, or a crisis to be averted, but our long-term strategies accept a calculated level of known and unknown risk- which affords us the confidence to keep buying anyway.

So with that preamble, we’ve compiled a short list of distractions that will most certainly not make you money in 2024. Despite dominating the daily news cycle, these distractions should ultimately be of little to no concern to your long-term objectives.

DISTRACTION #1 – THE US PRESIDENTIAL ELECTION…BUCKLE UP, IT’S GOING TO BE A DOOZY.

With many triggering social issues and characters up for election in 2024, it’s going to be critically important to separate political views from portfolio decisions. As citizens, voters and taxpayers, expressing political preferences by voting is crucially important…

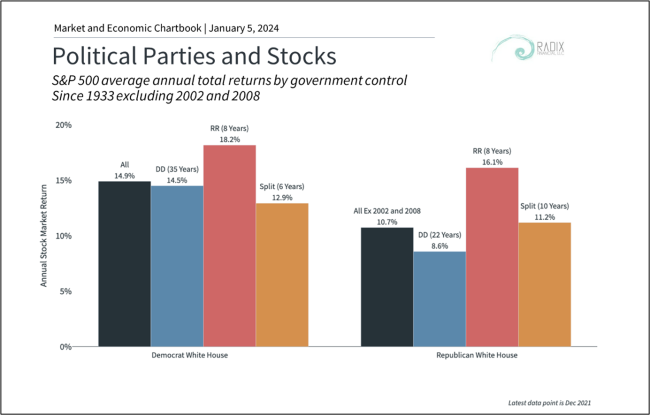

However, while Washington politics do affect our personal and professional lives, and legislation can impact specific industries and companies, they don't always impact the stock market the way we might expect. While it may seem unintuitive to some, history shows (see chart below) that markets can perform well in many political environments and leadership configurations across the White House and Congress.

DISTRACTION #2 – INFLATION…WE’RE OVER IT.

You know, we’re starting to think maybe those nerdy PhDs up at the Fed might actually be smarter than we’ve given them credit for. They’ve managed to bring inflation pressures back down from 9.1% in June of 2022 to 3.4% in December of 2023, all without significantly affecting job growth.

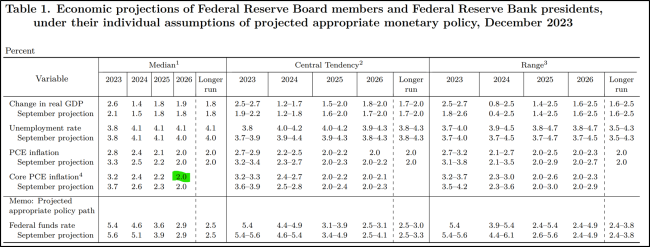

Up until a few weeks ago, the Fed had been banging the “strongly committed to returning inflation to its two percent target” drum so hard our ears were ringing. But then at the December meeting, and in its Summary of Economic Projections (“dot plot”) publication, all 19 Fed governors indicated they believed us to be at the peak of the hiking cycle. To further push the narrative, 17/19 Fed governors said they expect to lower interest rates during 2024.

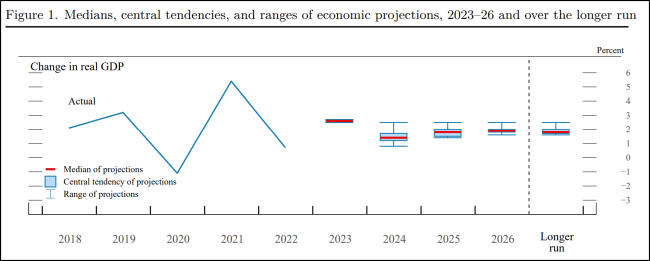

But what about 2%!? It’s clear from the chart below that the Fed projects real GDP to contract in 2024, a signal of worsening conditions. Whether that means the Fed will achieve the elusive ‘soft landing’ scenario or that the economy finally falls into a shallow recession is yet to be seen.

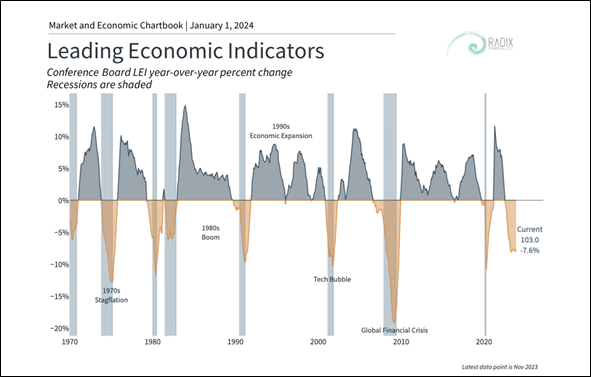

Leading indicator data seems to suggest we should have already been in a recession (see chart below), yet broader measures of employment and real GDP continue to come in above trend. Despite the rapid recovery in stocks, many sectors have experienced staggered reactions to the recent monetary restrictions (think last year’s regional banking crisis, tech crunch in ’22 due to higher cost of capital, housing demand decreased with increasing mortgage rates and the consumer sector as demand shifted back to services from goods coming out of Covid restrictions).

Today commercial real estate vacancies remain elevated from the "new normal" of flexible work and an increase in pre-pandemic office leases will be coming due for renewal in 2024. Could this again put pressure on regional banks, who have the most exposure to commercial real estate? Perhaps we’ll continue to see these rolling sector/industry recessions, as different areas of the market react and recover to higher rates at different times.

Other sectors within the market have remained resilient. The Economist predicts that international tourism will generate record revenue of $1.5 TRILLION this year, as post-pandemic wanderlust continues. Generative AI will undoubtedly add meaningfully to global GDP, as companies begin to transform their policies and procedures. A KPMG survey found that 80% of firms said they planned to increase their AI investments by over 50% by the middle of 2024.

Taken together, the data give us some important contextual clues about the FOMC’s rationale, which we can interpret to mean that for them, inflation 3-ish% is probably “close enough” for them to start considering the significant risks to the economy if rates are left too high for too long. Meanwhile, the FOMC has left themselves ample policy wiggle room by extending their forecasts for exactly when we should expect to see inflation reach 2% out until 2026 (highlighted in the table below).

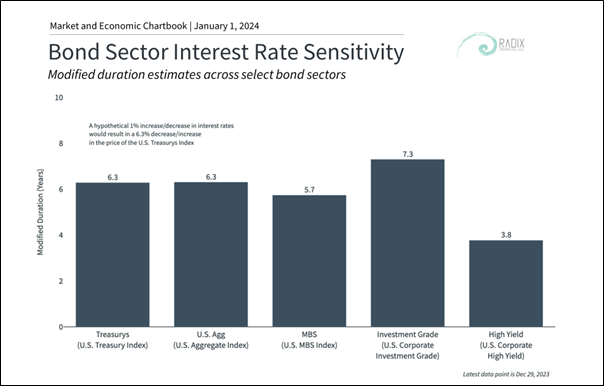

Going forward, the Fed will be watching to see that its dovish actions do not unintentionally re-ignite inflation. We don’t foresee this happening and believe monthly CPI readings will fail to garner the same market moving attention that it did in 2023. We also expect that the Fed will move very slowly in a downward trend towards a moderate neutral rate, which all else equal, should be stimulative for both equity (lower cost of capital) and credit markets (see chart below). Given their inverse relationship, bond prices will inherently rise as rates come down. The below chart shows how sensitive different areas of the bond market are to a 1% move in interest rates.

DISTRACTION #3 – THE NATIONAL DEBT…A 2025 PROBLEM.

The debt ceiling suspension deal that was reached earlier this year only kicked the can down the road to January 2025, but at least we’ll get a new Congress and a year’s respite from the political theatre surrounding the constantly looming fiscal cliff.

Undoubtedly, fiscal discipline has not been a priority in Washington for some time. And while the U.S. has never defaulted on its debt obligations, Washington has increasingly allowed these negotiations to come down to the wire despite most economists agreeing that allowing a default on Treasury securities would have untold effects across all parts of the global market and economy.

But despite the growing debt level, the stock market has performed well throughout many of these periods of political infighting. So at least for 2024, expect that the ongoing battles in Washington will likely increase market uncertainty and heighten concerns, but should otherwise be ignored completely by our investors.

WHAT SHOULD I FOCUS ON?

The year will bring its own challenges and opportunities for us all, most of which we don’t know and can’t even begin to predict. But as we tell all our clients, focus on the things you can control, and let us worry about the rest:

- Spend less than you make;

- Diversify your portfolio;

- Keep fees low;

- Stay tax efficient; and

- Avoid emotional errors

As always, we value your feedback and welcome any ideas.

Amy Hubble & Jessica Jablonowski

P.S. If you’ve not signed up for our New Year’s Challenge. There’s still time!