Truth And Lies: Uncovering The Truth About Life Insurance

I’m going to talk about life insurance. I’ve given you fair warning, turn back now if you can’t handle it.

I’m going to come right out with it. INSURANCE IS NOT AN INVESTMENT. Eh uh uh uh, before you say it…no, not even life insurance. Keep this perspective in mind as we go along.

Let’s start with a quick rundown of the two basic types of life insurance:

| Temporary | Term – Usually level premium for a fixed period of time, no cash value. Highest death value for the lowest premium. |

| Permanent |

Whole Life – Pay level premiums until age 100, cash value accumulates, typically most expensive. Universal Life – Features vary widely, but the idea is you pay more premiums early on (while you have earned income), and build up cash value that can then be utilized to pay the premiums (and reduce the death benefit) during retirement. Selling point is flexibility. |

The various alternatives and investment options available in permanent types of life insurance vary widely, are very complex, and come with books of disclosures. It can be overwhelming, and it makes asking intelligent questions difficult on the fly. But before you even think of asking questions of your life insurance planner (salesman), you need to understand what your needs really are.

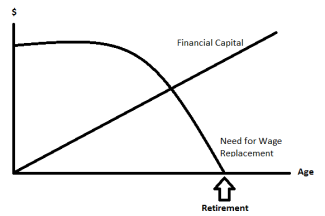

Your need for life insurance should be in terms of wage replacement for the premature death of the primary income earner. That is what you’re insuring against: premature death before you are able to recognize your full lifetime earnings and savings potential. Right? If you are 35 years old your lifetime income potential is high, but your financial capital is low. However, this should reverse itself over time. If you would like to ensure that your family receives $100,000 a year for as long as you would have been working (assume 30 years), a quick time value of money calculation would predict you would need about $1.5 million in insurance coverage through a 30-year term-life insurance policy. That’s it. If you have no income that needs replacing (as during retirement), then you have no need for insurance. It would be like purchasing car insurance, but you have no car.

Okay, I know. At this point you want to argue that your desire is also to provide a gift to your heirs when you die naturally after a long happy life. I get that. However, the math is not in your favor by paying thousands of dollars a year in life insurance premiums across your entire lifetime. People who live full natural lives lose (financially). EVERYTIME. I’ve done the math. Over and over and over, even under the most conservative of return assumptions. In fact, insurance companies are banking on this. They employ armies of actuaries who run statistical models all day long designed to beat you at this game, and they are good at it. The fact they are still in business should tell you the house usually wins. The only way to beat the house is to die early, and that’s not winning folks.

These permanent life insurance policies are sold with promises of tax-free savings, ability to take loans, total flexibility, indexed equity like returns, minimum payouts, etc. But, remember this:

INSURANCE IS NOT AN INVESTMENT. INSURANCE IS INSURANCE.

You need to be treating life insurance as you treat all other types of insurance, with the intention of getting the highest benefit for the lowest price. The answer to that question is almost always a fixed term policy. There are a few circumstances where permanent life insurance may be appropriate. For example, it could be used as part of an estate tax payment strategy in conjunction with an irrevocable life insurance trust. But unless you have enough assets to worry about estate taxes (assets in excess of $10.86 million for a couple ßcall me!), term life insurance combined with a disciplined long-term savings and investment strategy will be the most financially favorable scenario.

If you’re young, and you’ve somehow already been sold a permanent life insurance policy, there’s still time to get out. If you’re a little older, you may be too deep in to turn back, but it’s still important to calculate your breakeven point so you know what your options are. Let us help you decide.

See, that wasn’t so bad, was it? If you have additional questions or just want to send me your thoughts, you can contact me at amy@radixfinancial.com.