Pow Pow Pow-er Deals: The New Investment Case for Utilities

As we reflect back on the third quarter of 2024 and look forward, the theme of energy seems to be at the forefront of both market performance and investor sentiment. Several key developments related to energy, utilities, and oil are shaping market dynamics in new ways:

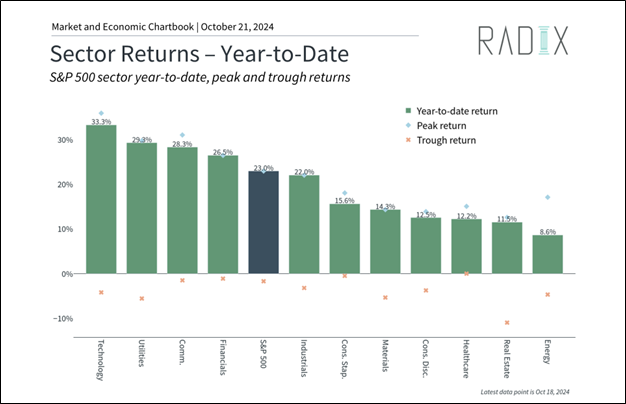

The Great Sector Rotation: Utilities Power Up

The U.S. stock market has seen a significant rotation in sector performance this year, with utilities emerging as a standout performer. Yes, you read that right, sleepy old utilities are amongst the top performers.

Traditionally viewed as a defensive sector, utilities have evolved into a critical player in the growth story, particularly as demand for electricity skyrockets due to the expansion of artificial intelligence (AI). AI is not just revolutionizing technology—it’s creating unprecedented demand on the power grid. ChatGPT alone uses more than 500,000 kWh of electricity per day[1]. To put it in perspective, the average US household consumes approximately 29 kWh per day.

Microsoft made headlines in late September by entering into a 20-year agreement with Constellation Energy to source nuclear power from the Three Mile Island nuclear plant. Less than a month later, Google announced a partnership with Kairos Power, followed closely by Amazon with Houston-based Talen Energy. These moves reflect the tech giants’ desperation to secure reliable, carbon-free energy for its AI-driven data centers.

The choice to invest in nuclear power is being touted as environmentally conscious, but it’s also economically strategic. As AI continues to grow, the energy needed to sustain their operations will surge, making competitive advantages for reliable and large-scale power sources essential. The era of AI-driven energy consumption has opened new opportunities for utility companies—once considered stable, income-generating assets—to be key players in the future of technological innovation, and the AI story.

Energy Storage: A Rising Necessity

With big tech going to great lengths (and great expense) to secure their own “off the grid” power, the surge in energy consumption brings with it another critical challenge—storage. With the rising demand for energy production, the ability to transport and store energy efficiently is paramount. Today, there are few cost-efficient battery storage options, and with the growing desperation of the major players to secure reliable power sources, large scale investment in storage innovation and infrastructure will follow.

This quarter, we added Generac Holdings to our portfolio, a company that has positioned itself as a leader within the energy storage and backup power sub-sector. Best known for backup home generators, Generac has expanded its offerings to include advanced energy storage systems, allowing both residential and commercial customers to store excess power for later use. The company's stock has risen over 18% since its inclusion in our portfolio in early September, reflecting the strong market sentiment surrounding the future of energy storage.

One of the key drivers for Generac’s success is its untapped market potential—90% of U.S. homes valued at over $150,000 have yet to install a backup generator. As the frequency of severe weather events continue to intensify and power outages become more common, the demand for backup power systems will only increase. Generac’s products are not only relevant for individual households but also play a crucial role in supporting the broader power grid. The company works closely with grid operators to help maintain reliability, especially during periods of peak demand.

The increasing importance of energy storage solutions cannot be overstated. As renewable energy sources like solar and wind grow in adoption, the ability to store that energy for when the wind isn’t blowing or the sun isn’t shining, is essential. Companies like Generac are at the forefront of this shift, providing both backup power solutions and long-term storage options that will be critical in balancing the grid and ensuring energy availability in the future.

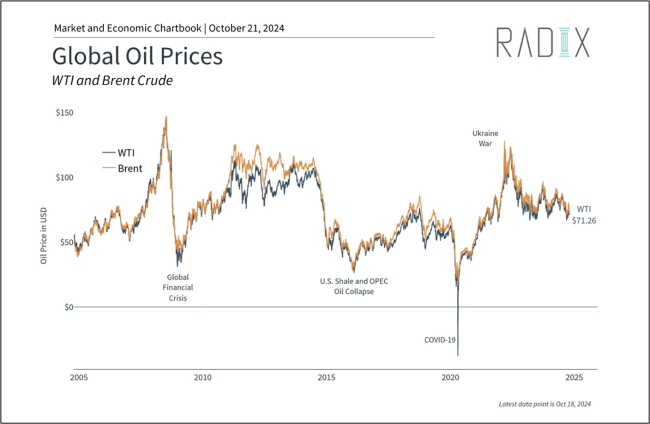

Oil Prices: A Persistent Global Influence

With recent news focusing on nuclear and renewable energy sources, it’s important to recognize that oil still remains a (if not the most) critical factor in the global economy. According to the EIA, about 60% of U.S. electricity generation comes from fossil fuels—coal, natural gas, and petroleum. About 19% from nuclear energy, and about 21% from renewable energy sources. This 60% figure is also consistent with electricity generation worldwide.

Oil prices have been a significant driver of inflation and market volatility over the past few years, and last quarter was no exception. Though oil prices have come down from their 2022 highs, they have risen again recently due to geopolitical tensions, particularly in the Middle East.

The conflict between Israel and Hezbollah/Iran has led to an increase in the price of Brent crude, which now sits around $75 per barrel. While this is still far below the 2022 peak of $128, the recent rise highlights the sensitivity of oil prices to geopolitical events.

As the world’s largest producer of crude oil, the U.S. is better equipped than ever to mitigate the effects of supply disruptions. But on the other hand, as the world’s largest consumer of oil, the U.S. is also at the greatest risk of supply disruptions. However, advances in exploration and drilling efficiency have boosted U.S. output, allowing the country to play a more prominent role in stabilizing global oil markets.

Oil prices are notoriously volatile, and the ongoing geopolitical tensions in the Middle East could lead to further spikes. At the same time, the world’s reliance on oil remains significant, and the impact of rising prices can ripple through the economy. Higher oil prices drive up the cost of gasoline, which acts as a tax on consumers by reducing disposable income and increasing costs for businesses.

From an investment perspective, navigating oil price fluctuations can be challenging, but diversification is key. The energy sector, particularly oil, can act as a hedge against inflation and market volatility, as evidenced by its performance during past periods of market stress. For example, in 2022, when the broader S&P 500 was down 18%, the energy sector posted a remarkable 66% gain. While past performance does not guarantee future results, maintaining exposure to energy-related investments can help buffer portfolios against the volatility that often accompanies rising oil prices.

Final Thoughts

In a quarter marked by significant shifts in the energy landscape, the importance of maintaining a diversified portfolio cannot be overstated. Whether its utilities benefiting from AI-driven power demand, companies like Generac capitalizing on the growing need for energy storage, or oil’s persistence in global markets, energy will continue to play a pivotal role in shaping market dynamics.

As always, we remain committed to identifying long-term opportunities and staying ahead of market trends to help our clients navigate the complexities of the global economy.

Yours Faithfully,

Amy & Jess

[1] https://www.newyorker.com/news/daily-comment/the-obscene-energy-demands-of-ai