Focus on the Things You Can Control

Happy New Year!

The start of the year is the perfect time to prioritize both personal and financial well-being. While physical health often takes center stage in New Year’s resolutions, financial fitness deserves equal attention.

Investing is hard. Making good decisions is hard. Having the discipline to make good decisions about investing— very hard to do consistently. Every day, new investment opportunities are being target advertised to high-net worth individuals, making it harder and harder to ignore the noise.

So this year, rather than write another boring forecasting letter about what the markets might (but probably won’t) do, I instead challenge you to redirect that anxious energy you feel over things you cannot control into actionable behavior that you can.

Here are some examples of things you cannot control over the next 365 days:

- What the market is going to do; or

- Who the President is

Here are some examples of things you can control over the next 365 days:

- Setting realistic savings targets;

- Reducing debt (if appropriate);

- Avoiding emotional errors[1];

- Minimizing fees;

- Optimizing your taxes; and

- Actually doing something with the cash sitting in your bank, brokerage, or old retirement account earning nothing

Frequent rationales we hear for not taking action are: fear of the markets (especially with markets near all-time highs), a future expectation that they might buy a property, the time demands of everyday life, or simply that they’re overwhelmed by the options and who to trust.

Sound familiar?

The reason those who can stay invested are rewarded in the long run is exactly because it is difficult to do so. When investors exit the market due to short-term concerns, they create opportunities for disciplined investors to buy at even more attractive prices, setting the stage for higher future returns. This is why keeping a level head, and investing over long periods of time, are the best ways to achieve financial goals.

James Clear, the bestselling author of “Atomic Habits” shared in his weekly newsletter this week that:

"Your habits are often a byproduct of convenience. Humans are wired to seek the path of least resistance, which means the most convenient option is often the one that wins. Make good choices more convenient and bad choices less so. Behavior will improve naturally."

Jess and I have spent the past several years listening to what our clients want and attempting to lean into human nature’s innate preference for convenience. We strongly recommend automating as much about your financial life as you can, and eliminating “is now the right time?” mentality when it comes to long-term savings. History has provided no greater friend to retirement savers than time + payroll auto-draft. And the earlier the better.

The accompanying chart shows how waiting even a few years can have a large impact. For an investor who experiences 7% average returns, beginning to invest when they are 35 rather than 30 means their original $1,000 investment grows to $7,612 instead of $10,677 when they retire. The same pattern is true whether those average returns are 3%, 5%, or 10%. Over the course of an investment lifetime, these differences add up and can become significant. Even small contributions can grow substantially over decades through the compounding process.

Despite the overwhelming odds against successfully predicting the future, people rarely want to talk to me about simple operational actions they can take today to guarantee success in the long run, opting instead for discussions about gold, Nvidia, and/or Bitcoin. And it’s not surprising with these assets returning 26.8%, 190.48%, and 124.8% respectively in 2024.

Let’s Talk About It

Despite that the US abandoned the gold standard over fifty years ago, and that there’s not a single country in the world still using it, central banks and investors continue to buy it because of the belief that the price will continue to appreciate indefinitely, hedge inflation, and provide diversification benefits to portfolios. Which it has, for over 50 years.

But gold has never made much sense to me.

It’s just a shiny rock. It has value only because we collectively agree that it has value. For the price to continue to go up there must be more demand than supply, and I have to believe we’re nearing a point where you run out of people and voter support for shiny rocks that sit in vaults and earn nothing.

Maybe I’m wrong. Heck, they’re selling gold bars at Costco now, but very few of my millennial and Gen X peers have any interest in owning gold. If they’re going to take a chance with an asset without intrinsic value, they’d rather participate in something that is culturally or technologically relevant (like Bitcoin) or something that is at least paying them interest (like US dollars).

Let’s compare gold to a company like Nvidia, which we’ve owned since September of 2021 within our diversified core portfolio. Since then, the stock has returned 575% and generates revenue of $140+ billion dollars a year. The stock price $150 puts its earnings multiple at almost 60. Whether that’s cheap or expensive is in the eye of the beholder who must conjecture up a future growth rate and arrive at its “fair value” relative to its peers and the overall market.

But in this modern trading era, valuations don’t matter. Your investment is worth what someone else is willing to pay for it. No more, no less.

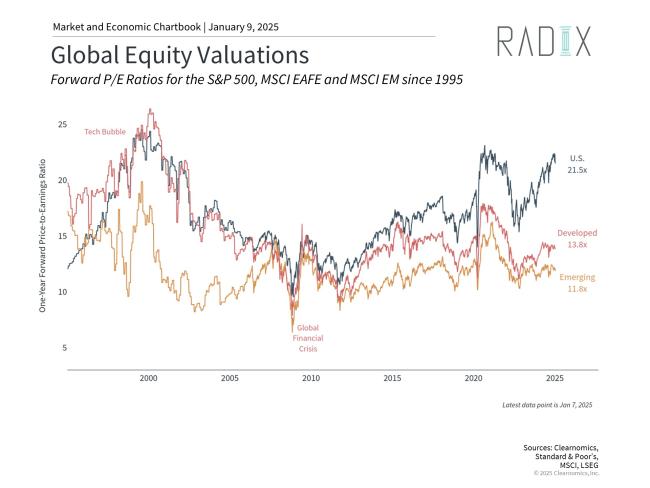

Look at global developed market stocks. They’ve been undervalued relative to the US market for practically my whole career. And yet, from 2007 through 2024 the MSCI EAFE Index (comprised of stocks from developed international markets, excluding the US) has outperformed the S&P 500 only five of the last 18 years.

In the short-run, sentiment (vibes and hype) matter, but in the long-term, what matters is a company’s ability to keep growing revenue or a trading asset’s ability to consistently entice more buyers than sellers.

It’s a dangerous game, and it’s why investing can often be confused with gambling.

Which brings me to Bitcoin…

In the wake of the election, we saw Bitcoin’s price briefly overtake $100,000 on the hope that the new administration will look more favorably on crypto, blockchain, and digital assets.

But like gold, it suffers the same problem of having no intrinsic value and the requirement to always be recruiting new money for the price to rise. Eventually the world runs out of bros wanting to buy internet money, and when demand slows, the price plummets, because what’s the fun in owning a nothing asset that doesn’t go up in price?

Unless…global central banks begin holding it on reserve. There’s only one buyer in the market that can support an indefinite rise, because that buyer can print fiat money to buy it.

When asked about it in the December press conference, FOMC Chair Jerome Powell reiterated that the Fed is “not allowed to own Bitcoin, that’s the kind of thing for Congress to consider, but we are not looking for a law change at the Fed.”

Whether that tone changes with the new administration or a new Fed Chairman, when Powell’s term expires in 2026, is yet to be seen. And while I do not own any personally or recommend it for my clients, it’s clear the entire virtual asset industry is seeing new life.

Final Note

This month, Radix will celebrate its 10th Anniversary. I sincerely want to thank our clients, especially those that took a chance with me, then a 30-year-old idealistic know-it-all, with zero assets to manage. Today, Jess and I manage over $200 million and have operations in three countries. I’m really proud of what we’ve done here, and I look forward with confidence to the next 10 years!

Gratefully,

Amy Hubble

[1] Ben Carlson recently wrote a great piece about investment mistakes, I’d recommend everybody read after this.