Preparing for the Inevitable: Death and Taxes

And now for some potentially good news…

Buried under the current policy chaos that has erupted this week from Trump’s reciprocal tariff announcement and the 100+ Executive Orders signed, is a new legislative effort to repeal what is morosely referred to as “The Death Tax.”

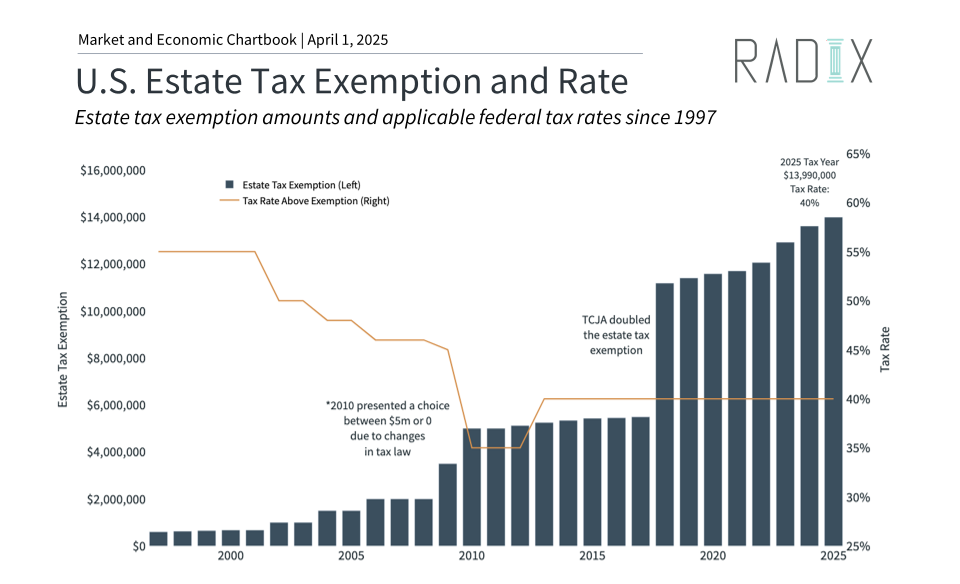

For most but the super wealthy, the notion of estate and gift tax has been a welcome non-issue for many years.

Today, US citizens can give away, during their lifetime or at death, $13.99 million. This value is portable or duplicated between spouses and is in addition to the $19,000 you’re permitted to give away tax-free to an unlimited number of natural persons every year. Not to mention, the cherry on top of the sundae – the step-up in basis, ensuring that estate heirs also avoid capital gains tax on appreciated investments.

These high exemption hurdles mean that only about 0.2% of estates in the US are taxable. But for those lucky few, the tax rate is set at a punishing 40%.

For non-US persons who own US-situated assets (like stocks) titled in their individual name, the estate tax exclusion is VERY LOW, set at only US $60,000; a paltry and non-inflation adjusted amount when compared to the exemption amounts enjoyed by US persons.

All of these provisions are set to sunset at the end of 2025, meaning if no action is taken, the exemption will be halved, potentially making 2025 a crucial year for gift planning if no action is taken in Washington.

What is Being Proposed

While the “Death Tax Repeal Act” is only in the proposal stages (but could potentially be rolled into Trump’s “Big Beautiful” stimulus bill this year), Republican-led bills to fully repeal the estate tax are currently gaining momentum in both the House and the Senate.

Foreign investors potentially have the most to gain with a repeal of the estate tax, meaning they would no longer need to worry about estate tax exposure or implementing complex structures to invest in the US. Removing a key disincentive for foreign investors would assumably also make direct investment within the US more favorable and boost economic growth. Win Win.

Lifetime gift tax exemptions and credit amounts are currently unified with the estate tax and often work together in estate planning to make gifts into irrevocable trusts or limited partnerships with the intention of shifting future growth out of your estate and into the hands of family members. Both the House and Senate version of the bills retain the gift tax, but reduces the highest rate from 40% to 35% and contains a $10 million lifetime exemption.

The basis step-up, which benefits all heirs of non-qualified investment accounts and real-estate, is also preserved within both bills. A key provision for middle class Americans otherwise not affected by the estate tax repeal.

Potential Implications for Wealthy US Persons

One of the reasons that a complete repeal of the estate tax has been politically unpopular is that it overwhelmingly benefits families with joint estates in excess of $28 million and contributes to wealth inequality. But, with a GOP led President, House, and Senate̶ now is as favorable a time as any we’ve seen.

But things are rarely that simple. Risk remains as to future political uncertainty. Even with a full repeal of the estate tax, wealthy families would likely still be hesitant to unwind or halt multi-generational estate planning and trust structures to bring assets back into their estates and expose themselves to potential creditor liability.

That said, a full step-up in basis and the ability to transfer business assets at no cost upon your death may prove too strong an incentive for those who believe themselves nearer to death.

Implications for Non-US Persons with US-Situated Assets

US companies currently account for 65% of global equity market capitalization. The market cap of Microsoft alone is worth more than the annual GDPs of all but four countries in the world. With such a high concentration of global growth driven by US companies, global investors would be derelict to exclude US exposure in long-term investment portfolios, even in the current tumultuous environment.

But if careful planning is not undertaken when investing in US situated assets, non-US persons could inadvertently be exposing their estate heirs to a punishing tax bill, complicated filing requirements, and a long wait time.

Unlike US-persons, whose potential US estate tax liability applies to all worldwide holdings, non-resident, non-citizens (NRNCs) are only subject to US estate tax on their US-situated assets.

How Much are We Talking?

It’s graduated, but depending how much OVER $60k in US situated assets you hold at your death, your estate tax liability will be between 18-40% of your US gross estate.

Let’s take a basic example:

Say a NCNR decedent owned $1.4 million in US situated assets and cash within a US brokerage firm (like Interactive Brokers, a common retail custodian for Caribbean residents).

The first $60,000 would be excluded at 0%, for a taxable US gross estate of $1,340,000

Total tax would be a base $345,800 + 40% over $1 million ($340,000*0.40) = Total potential tax liability of $481,800 or 34.4% of the total estate due to the IRS before they will issue a transfer certificate to your custodian.

Ouch. What is the Process If I Were to Die Unexpectedly?

When an individual account owner dies, the custodian of the assets will request several documents from the decedent’s executor, this varies somewhat from jurisdiction to jurisdiction and custodian to custodian, but generally you will need to provide:

- Certified copy of the death certificate – confirming death

- Certified copy of the will and/or grant of probate – establishes who has the right to collect and distribute assets under the will

If a non-US citizen, non-resident dies and the only US situated assets are within a US brokerage account, custodians will then generally request the executor to provide them, either:

- A small estate affidavit signed by the executor or heir (less than USD $60k in US assets.)

- Or if the decedent owned greater than $60k in US domiciled assets on their date of death, they will require an “IRS Transfer Certificate” before releasing the funds to the beneficiaries.

- If the decedent died with multiple US situated assets (particularly Real Estate) a full ancillary probate will likely be required anyway, after which an estate tax release letter would be issued by the State in lieu of a transfer certificate.

How Hard is it to Get an IRS Transfer Certificate?

A transfer certificate will be issued by the IRS when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. This process can take anywhere from 6-18 months.

First, the executor must determine if it’s necessary to file a Form 706-NA. The executor must file Form 706-NA within nine months of the date of death if the value of the nonresident non-citizen decedent’s U.S.-situated assets, together with the gift tax specific exemption and the amount of adjusted taxable gifts, exceeds the filing threshold of $60,000.

Other important things to note:

- Transfer on death beneficiary designations are not permitted for non-US persons

- Joint Tenancy with Right of Survivorship titling also does not automatically transfer to the surviving owner without an IRS transfer certificate

Countries with Estate Tax Treaties with the US (note this is the country of domicile at death, not nationality or citizenship): Australia, Austria, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Netherlands, South Africa, Switzerland, and the United Kingdom.

What Counts as a US-Situated Asset?

- US stocks, examples:

- shares of Apple, Google, Coca-Cola, Wal-Mart, etc.

- US domiciled ETFs and Funds, examples:

- SPY (S&P 500 Index ETF), BIL (US Treasury Bill ETF), VEA (Yes. Including US domiciled funds and ETFs that only invest in international securities)

- Cash in a US brokerage account

- Cash in your Interactive Brokers account counts.

- Real Estate and tangible personal property physically located in the US

What is Excluded?

- Foreign stocks that trade on US exchanges as ADRs (American Depository Receipts);

- US Dollars held in foreign banks or funds;

- Deposits with a U.S. bank or a U.S. banking branch of a foreign corporation not effectively connected with conducting a trade or business within the United States;

- Most fixed income securities if the interest on them would be eligible for tax exemption under section 871(h)(1); and

- Most US corporate bonds

- US Treasury obligations

- Foreign domiciled funds and ETFs that invest in US securities

- Irish domiciled UCITS ETFs and Funds

- Cayman/BVI funds – like First Pillar

What Can I Do?

- Minimize US securities exposure to under US$60,000;

- Place assets in a trust or business structure;

- Indirect investment through foreign domiciled funds and ETFs that invest in US securities;

- Reach out to Radix, we can help you calculate your potential estate tax liability and make recommendations how to reduce it.